Tax Control Framework (TCF): what it is and why it’s becoming essential

What is a Tax Control Framework, and why will it become mandatory?

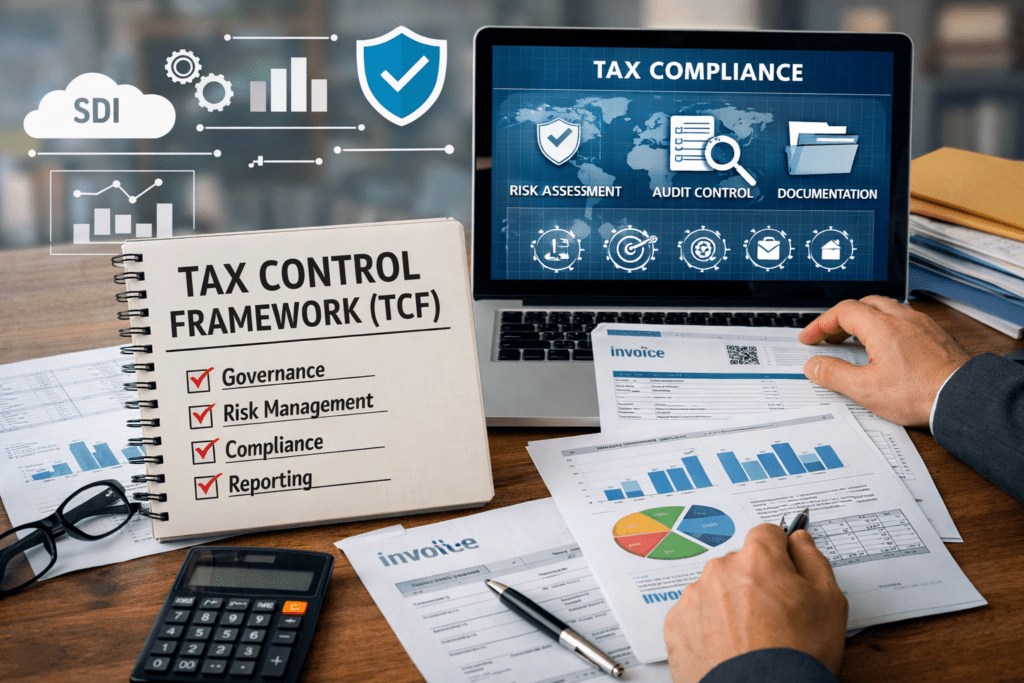

In recent years, the topic of tax governance has moved beyond a technical niche to become a central element of corporate management. In this context, the Tax Control Framework (TCF) is the tool through which a company demonstrates that it has a structured system for managing and controlling tax risk. It is not just a “trend” or something reserved for multinationals: more and more groups, including mid-sized ones, are considering adopting it as part of a strategic, preventive approach.

What is a Tax Control Framework?

A Tax Control Framework is the set of:

- mapped and documented tax processes,

- preventive and subsequent controls,

- clearly assigned roles and responsibilities,

- structured information flows between corporate functions,

- tools for monitoring and reporting tax risk.

In other words, the TCF is the “organizational model” for corporate tax matters. It shows the tax authorities that the company does not merely comply with filing requirements, but manages tax risk in a conscious and systematic way.

Why it is becoming (in practice) mandatory

There is not yet a general requirement for all companies to adopt a TCF, but the overall context is clearly moving in that direction:

- Cooperative compliance / collaborative compliance regimes require a tax risk control system;

- Automatic exchanges of information, DAC6, CbCR, and global minimum tax regimes increase cross-checks;

- Tax authorities are increasingly focusing on the quality of processes, not just the reported outcome.

For many businesses—especially structured groups—the TCF therefore becomes a de facto prerequisite for engaging transparently with the tax authorities and reducing the risk of significant disputes.

The tangible benefits for the company

Adopting a TCF delivers very practical benefits:

- reduced risk of errors and penalties, thanks to preventive controls;

- a stronger position in the event of an audit, because processes are tracked and documented;

- greater operational efficiency, with fewer “heroic” last-minute efforts around deadlines;

- greater credibility with banks, investors, and auditors, who see a more advanced governance model.

How to set up the process within the company

Implementation always starts with:

- an initial assessment of the tax set-up and existing processes;

- the mapping of the most relevant tax risks;

- the design of procedures and controls aligned with the company’s operational reality;

- the involvement of all key functions (Tax, Finance, HR, Legal, IT, Controlling).

Conclusions

A TCF is not just about compliance—it is a competitive advantage: it reduces risk, improves decision-making quality, and makes the company more resilient to regulatory change. The sooner you act, the better.

D. Di Teodoro

managing partner