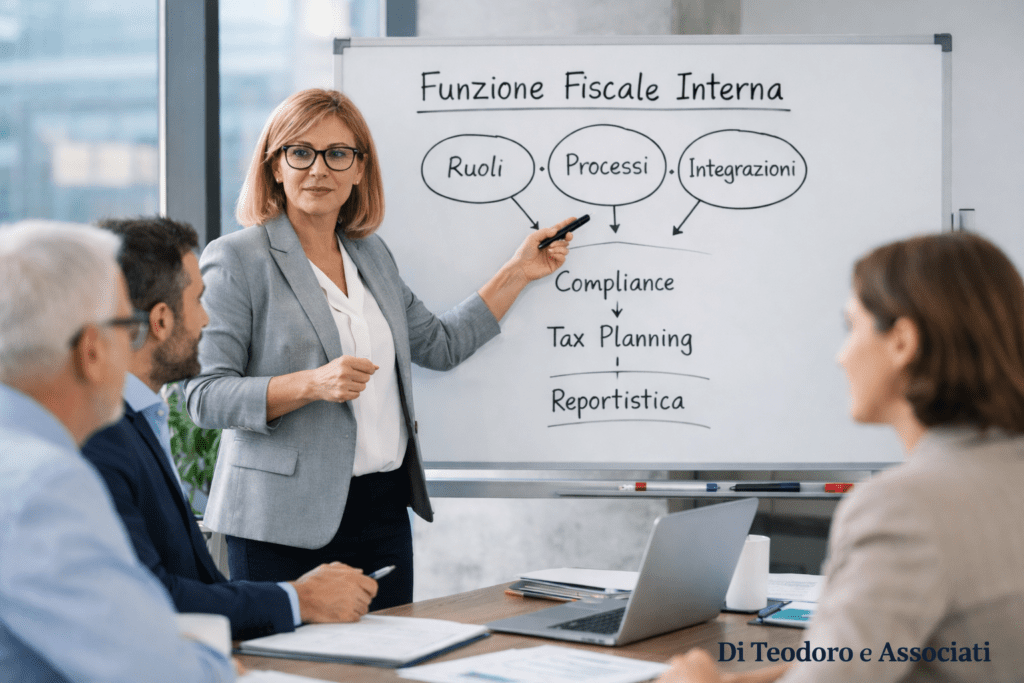

In-house tax function: how to structure it (roles, processes, integrations)

In recent years, many companies have realized a simple truth: tax is no longer just a matter of “compliance.” With evolving regulations, more sophisticated audits, increased information sharing, and growing attention to governance, having a well-structured **in-house tax function** means **reducing risks**, improving data quality, and making more informed decisions.

What is an in-house tax function (and why is it needed)?

The **in-house tax function** is the set of people, procedures, and tools responsible for overseeing:

tax compliance (returns/filings, payments, deadlines, checks and controls)

tax accounting (current and deferred taxes, periodic closes)

decision support (contracts, investments, M&A, reorganizations)

tax risk management (risk mapping, controls, documentation)

relations with external advisors and with the tax authorities

When does it make sense to set it up?

Typically, the need becomes clear when:

the volume of compliance requirements increases (multiple entities, cross-border activities, complex VAT)

internal processes are not properly tracked (over-reliance on individual people)

audits become more frequent and you need documentation ready at hand

there are extraordinary transactions (M&A, contributions in kind, reorganizations)

you need a solid oversight of **transfer pricing** or other cross-border matters

Objectives: what an effective and efficient tax function should ensure

A good tax function is not “more bureaucracy.” It’s an engine that should deliver four things:

Compliance: deadlines met, consistent filings, well-organized documentation

Control: risks mapped, internal safeguards and checks, traceable evidence/audit trail

Efficiency: fewer manual tasks, reliable data, automation where possible

Business support: fast, consistent answers for Sales, Procurement, HR, and Finance

Roles in the in-house tax function: who does what

The structure depends on the company’s size and complexity. However, the “typical” roles are fairly consistent.

1. Head of Tax / Tax Director

They are the point of reference for the function. Typically, they:

define tax policies, priorities, and tax governance

manage external advisors and relationships with tax auditors/inspectors

oversee strategic matters (extraordinary transactions, international tax, transfer pricing)

validate key tax positions and coordinate tax risk management

Key skills: a broad, end-to-end view, strong governance capabilities, the ability to work closely with the CFO/CEO, and risk management expertise.

2. Tax Specialist (tax compliance and direct taxes/VAT)

This is the hands-on role that:

prepare and/or coordinate tax returns/filings and deadlines

support tax accounting and the recording of taxes in the accounts

handle recurring questions (invoicing, reverse charge, withholding taxes, etc.)

keep documentation up to date

3. Tax Accounting / Taxes in the financial statements (often in coordination with Finance)

It becomes necessary as complexity increases:

reconciliations and tax provision calculations

deferred tax assets and liabilities (DTAs/DTLs)

support for month-end and quarter-end closes

4. Tax Governance & Controls (sometimes a hybrid role with Internal Audit/Compliance)

An increasingly important role:

map tax risks

define key controls (e.g., VAT controls, reconciliations)

maintain evidence and an audit trail

coordinate remediation actions in response to findings/issues

5. Internal interfaces: CFO, Accounting, Legal, HR, Procurement, Sales

Even if they don’t formally “belong” to the tax function, they are essential because tax sits within the company’s day-to-day processes:

Accounting/Finance: accounting data and reporting

Legal: contracts, governance, disputes/litigation

HR: payroll, travel and expenses, benefits, secondments/assignments

Procurement/Sales: VAT, withholding taxes, and commercial contracting

Practical tip: defining a **RACI** (Responsible/Accountable/Consulted/Informed) matrix for the main tax processes helps reduce errors and organizational “gaps.”

Key processes: the “backbone” of the tax function

To be effective, the tax function needs clear, repeatable processes. These are the most important ones.

1. Tax compliance calendar and deadline management

a centralized deadline calendar (VAT, withholding taxes, tax returns/filings, CU, Form 770, etc.)

clear responsibilities (who prepares, who reviews, who files/submits)

documented review evidence (checklists and approvals)

Useful KPIs: percentage of deadlines met, rework, errors corrected after submission.

2. VAT management (sales and purchase cycles)

A process that is often “high risk”:

checks on VAT codes and reverse-charge treatment

management of credit and debit notes

reconciliations of VAT ledgers and VAT returns/settlements

management of cross-border transactions (where applicable)

Output: operating procedures plus periodic controls/checks.

3. Direct taxes and tax provision

data collection for IRES/IRAP (or equivalent corporate taxes)

accounting-to-tax reconciliations

calculation of current and deferred taxes

support for periodic closes

Output: standardized working files, methodology notes, and approvals.

4. Management of rulings, disputes, and tax audits

Here, a structured approach is essential:

a log/register of requests and open positions/issues

a document repository for supporting evidence

an approval workflow (who signs/approves what)

lessons learned: updating processes after a finding/observation

5. Tax risk management (risk map + controls)

It’s what turns the tax function into a true governance safeguard:

risk identification (VAT, withholding taxes, cross-border matters, tax incentives, transfer pricing, etc.)

assessment of impact and likelihood

definition of controls and owners (responsible parties)

periodic testing and reporting to management

Integrations: where quality is “won or lost” (people + systems)

If processes are the backbone, integrations are the nervous system. This is where many tax functions fail—not because of a lack of expertise, but because data arrives late or is incorrect.

Integration with Administration, Finance, and Controlling (AFC)

alignment on the chart of accounts and classifications

month-end closing workflows (tax provision)

standard reconciliations (VAT, withholding taxes, fixed assets)

Periodic reports: risks, deadlines, provisions (accruals)

Integration with Legal and Procurement/Sales

Contract templates with standard tax clauses

Tax review of “sensitive” contracts (foreign, royalties, services, agents)

Correct classification of transactions (services/goods, VAT place-of-supply rules)

Integration with HR (payroll and mobility)

Benefits, business travel, secondments, stock options (if any)

Policies and controls to reduce recurring errors

Integration with systems (ERP, e-invoicing, document management)

If you want to scale, you need to standardize:

VAT codes and master data (customers/suppliers) with clear rules

Automated controls (e.g., alerts for inconsistent VAT codes)

Document archiving with search capabilities and an audit trail

Dashboard for deadlines and controls (even a simple one, as long as it’s actually used)

Organizational models: 3 simple examples (from an SME to a group)

Model A — SME (lean)

1 responsible owner (even part-time) + 1 operational point of contact

External advisor for peaks and specialist topics Pros: fast and cost-effective. Cons: risk of dependency on individuals.

Model B — Mid-size / multi-entity

Head of Tax + compliance specialist + tax accounting support

Standard procedures and a controls calendar Pros: better control. Cons: requires discipline in following processes.

Model C — Group / international

Internal team with dedicated expertise (VAT/direct taxes, tax accounting, governance)

Coordination with Finance and local country managers Pros: strong oversight. Cons: requires tools and reporting.

Operational checklist: how to set it up

If you want a simple, practical roadmap:

Map key compliance obligations and main risks (what, when, and where the data originates)

Create a RACI for 10 key tax processes

Define a single consolidated deadlines calendar with an owner and a backup

Standardize 3 high-impact controls (VAT, withholding taxes, reconciliations)

Set up an internal tax data room (an organized repository)

Define minimum KPIs (deadlines, rework, findings, response times)

Formalize the relationship with external advisors (SLAs and scope)

Common mistakes to avoid (very frequent)

A “purely reactive” tax function (chasing deadlines without controls)

Lack of clear accountability (who actually checks?)

Upstream data not governed (dirty VAT codes / master data)

Scattered documentation (in the event of an audit, you lose time and credibility)

Excessive dependency on a single key person (operational risk)

FAQ: frequently asked questions about the in-house tax function

How to tell if you need an in-house tax function?

If you have growth, multiple entities, foreign operations, extraordinary transactions, or frequent audits/issues, an in-house function (even a small one) helps reduce risks and inefficiencies.

How many people do you need?

It depends on complexity. Many SMEs start with 1 responsible owner + 1 operational point of contact, supported by external advisors for specialist topics.

Is it better to insource or outsource?

Often the best solution is a hybrid one: in-house for governance, controls, and coordination; external for specialist expertise and peak workloads.

What’s the first process to bring under control?

Often: VAT and the correctness of order-to-cash / procure-to-pay flows, because mistakes here multiply quickly.

What minimum tools do you need?

A single consolidated deadlines calendar, an organized document repository, procedures and checklists, plus a few standard reconciliations. The ERP helps, but without rules and owners it remains ineffective.

In conclusion

Structuring an in-house tax function means building a stable framework around roles, processes, and integrations. Even a small function, if well organized, can:

prevent recurring errors

handle audits and requests more effectively

make tax a support for decision-making (not a brake)

Daniele Di Teodoro

managing partner